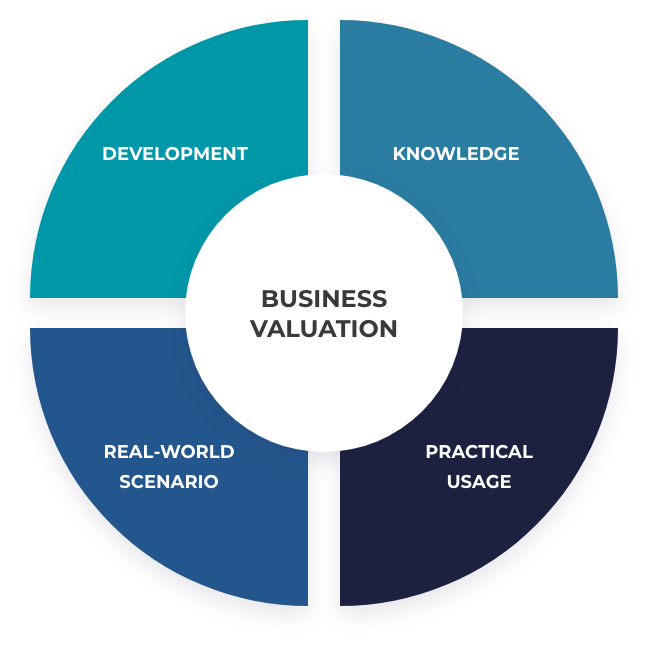

This intensive Business Valuations training would provide comprehensive knowledge on business valuation techniques and enable the participant to build robust financial models, conduct business valuation and make effective strategic and investment decisions. This interactive online course would be highly value adding for finance, investment research and MIS professionals, and investors and students who would like to gain in-depth knowledge in business valuation.

This program combines ACCA’s Certificate in Business Valuation curriculum with analytical techniques and practical sessions to offer both theoretical knowledge and application skills. Upon successful completion of the course, participants who registered for Certificate from ACCA option, will receive Certificate in Business Valuations directly from ACCA.

Optionally, at the end of course completion, participants would have the opportunity to build a full-fledged financial model and conduct business valuation under our guidance (additional charges apply for this course feature). This will simulate the real-world situation of a Wall Street analyst and would be a great opportunity to practically apply the knowledge gained in the program and receive a certificate with a grade based on our assessment criteria. Modelling assignment must be completed within a month of completing the program. Assistance will be provided throughout the 1-month period.

UMASUDHAN SUBRAMANIAM is a seasoned management consultant and corporate trainer with vast experience in training professionals in all areas of Strategy, Finance, and Risk Management.

Umasudhan has worked in the commercial sector over the last 20+ years in various industries such as commercial banking, investment banking (equities), manufacturing, trade, advisory services & audit. He held various senior management positions within the commercial spectrum.

Umasudhan was part of the Exam Development Team of FRM Examinations held by GARP – USA. He was also part of the CFA Institute’s (USA) Education Advisory Board working body. He is an approved mentor for Oxford Brookes University’s (UK) BSc in applied accounting degree program.

Umasudhan is a CFA charter holder, a certified FRM, a fellow member of ACCA-UK, an associate member of CIMA-UK, a fully qualified CPA-Australia and holds a master’s degree in professional accountancy from the University of London/ University College London.